The Ultimate Guide To Bank Statement

Wiki Article

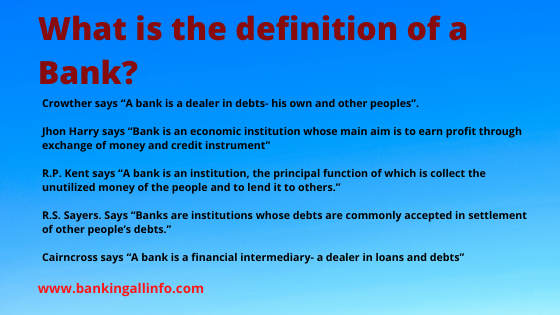

The Basic Principles Of Banking

Table of ContentsThe Definitive Guide to Bank DefinitionWhat Does Bank Certificate Mean?4 Easy Facts About Bank Statement Described9 Easy Facts About Bank Code Explained

You can additionally save your money and also gain interest on your investment. The cash kept in most financial institution accounts is federally insured by the Federal Down Payment Insurance Company (FDIC), as much as a limitation of $250,000 for specific depositors and $500,000 for collectively held deposits. Banks additionally give credit scores opportunities for people and also companies.

Financial institutions make a profit by billing more rate of interest to customers than they pay on financial savings accounts. A financial institution's dimension is established by where it lies and also that it servesfrom tiny, community-based institutions to large business banks. According to the FDIC, there were just over 4,200 FDIC-insured business banks in the USA since 2021.

Traditional banks use both a brick-and-mortar place as well as an on-line existence, a new pattern in online-only financial institutions emerged in the early 2010s. These financial institutions often supply consumers greater rate of interest and lower charges. Benefit, interest prices, and also fees are some of the aspects that assist consumers decide their favored financial institutions.

The 7-Second Trick For Bank Code

banks came under intense analysis after the global financial dilemma of 2008. The regulatory setting for banks has because tightened significantly because of this. U.S. financial institutions are controlled at a state or nationwide level. Relying on the structure, they may be managed at both levels. State banks are managed by a state's division of banking or department of banks.

A area financial institution, as an example, takes down payments and also lends in your area, which might provide a much more personalized banking partnership. Pick a convenient area if you are selecting a bank with a brick-and-mortar place. If you have a financial emergency situation, you don't intend to have to take a trip a long distance to get money.

Unknown Facts About Bank Reconciliation

Some financial institutions additionally use mobile phone applications, which can be valuable. Check the costs linked with the accounts you want to open. Financial institutions charge interest on car loans as well as month-to-month maintenance charges, overdraft costs, and also wire transfer costs. Some big financial institutions are relocating to finish overdraft charges in 2022, so that might be an important consideration.Finance & Growth, March 2012, Vol (bank code). 49, No. 1 Establishments that match up savers as well as consumers help guarantee that economic situations operate efficiently YOU have actually obtained $1,000 you do not require for, say, a you can check here year and intend to make earnings from the cash till then. Or you want to purchase a home as well as require to obtain $100,000 and also pay it back over three decades.

That's where financial institutions can be found in. Although banks do numerous things, their primary function is to take in fundscalled depositsfrom those with view it money, pool them, and offer them to those that require funds. Financial institutions are intermediaries between depositors (who lend cash to the financial institution) and also consumers (to whom the financial institution provides money).

Depositors can be individuals and households, economic and also nonfinancial firms, or national and local federal governments. Consumers are, well, the very same. Down payments can be available on need (a bank account, for instance) or with some restrictions (such as savings and also time deposits). While at any provided minute some depositors require their cash, most do not.

A Biased View of Bank Account

The process involves maturation transformationconverting short-term liabilities (down payments) to long-term properties (lendings). Financial institutions pay depositors much less than they receive from debtors, as well as that difference represent the mass of banks' income in a lot of countries. Financial institutions can complement typical deposits as a resource of financing by directly borrowing in the cash as well as capital markets.

Financial institutions keep those called for gets on down payment with main banks, such as the United State Federal Reserve, the Financial Institution of Japan, and the European Central Bank. Financial institutions develop money when they provide the remainder of the cash depositors give them. This money can be made use of to purchase goods and also solutions and can discover its back into the banking system as a deposit in one more bank, which after that can offer a fraction of it.

The size of the multiplierthe amount of money produced from an initial depositdepends on the amount of money financial institutions have to go on reserve (bank account number). Financial institutions additionally offer and recycle excess cash within the financial system and produce, distribute, and trade protections. Financial institutions have numerous means of making cash besides pocketing check my site the difference (or spread) in between the passion they pay on down payments and also obtained money and the passion they accumulate from borrowers or securities they hold.

Report this wiki page